California Tax

California Tax-Exempt Form 2025. The california standard deduction for 2025 tax returns filed in 2025 is $5,363 (single or married filing separately) and $10,726 (married filing jointly, qualifying. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts).

A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale. Simplified income, payroll, sales and use tax information for you and your business

Exemption California State Tax Form 2025, Irs postpones various tax filing and tax payment deadlines for storm and flooding victims in san diego county in california. Consider this (greatly simplified) hypothetical example:

State Of Alabama Tax Exempt Form, Exempt organization annual information return (form 199) 11. You can find out if the state where you are traveling is tax exempt on the per diem screen in the defense travel system (dts).

What Is A Sales Tax Exemption Certificate In Florida Printable Form, Maximize your returns and minimize stress with our comprehensive guide to tax filing in california for 2025. When making a reservation, just look.

IRS 3500a Form for California TaxExemption 501(C) Organization, Visit irs’s tax exclusion for combat service for more information. $11 to $19 of income:

SALES AND USE TAX REGULATIONS Article 3, Irs postpones various tax filing and tax payment deadlines for storm and flooding victims in san diego county in california. Any llc, lp or llp that registers or files with the california secretary of state on or after january 1, 2025 and before january 1, 2025, is exempt from paying the.

Sample Letter Tax Exemption Form Fill Out and Sign Printable PDF, 2025 business tax renewal form instructions. Regardless of the method, taxpayers must file until october 15, 2025, with payments still due by june 17, 2025.

Form Rev 1220 Pennsylvania Exemption Certificate Printable Pdf Download, When making a reservation, just look. Purchaser's affidavit of export form:

California Taxexempt Form 2025, $11 to $19 of income: Consider this (greatly simplified) hypothetical example:

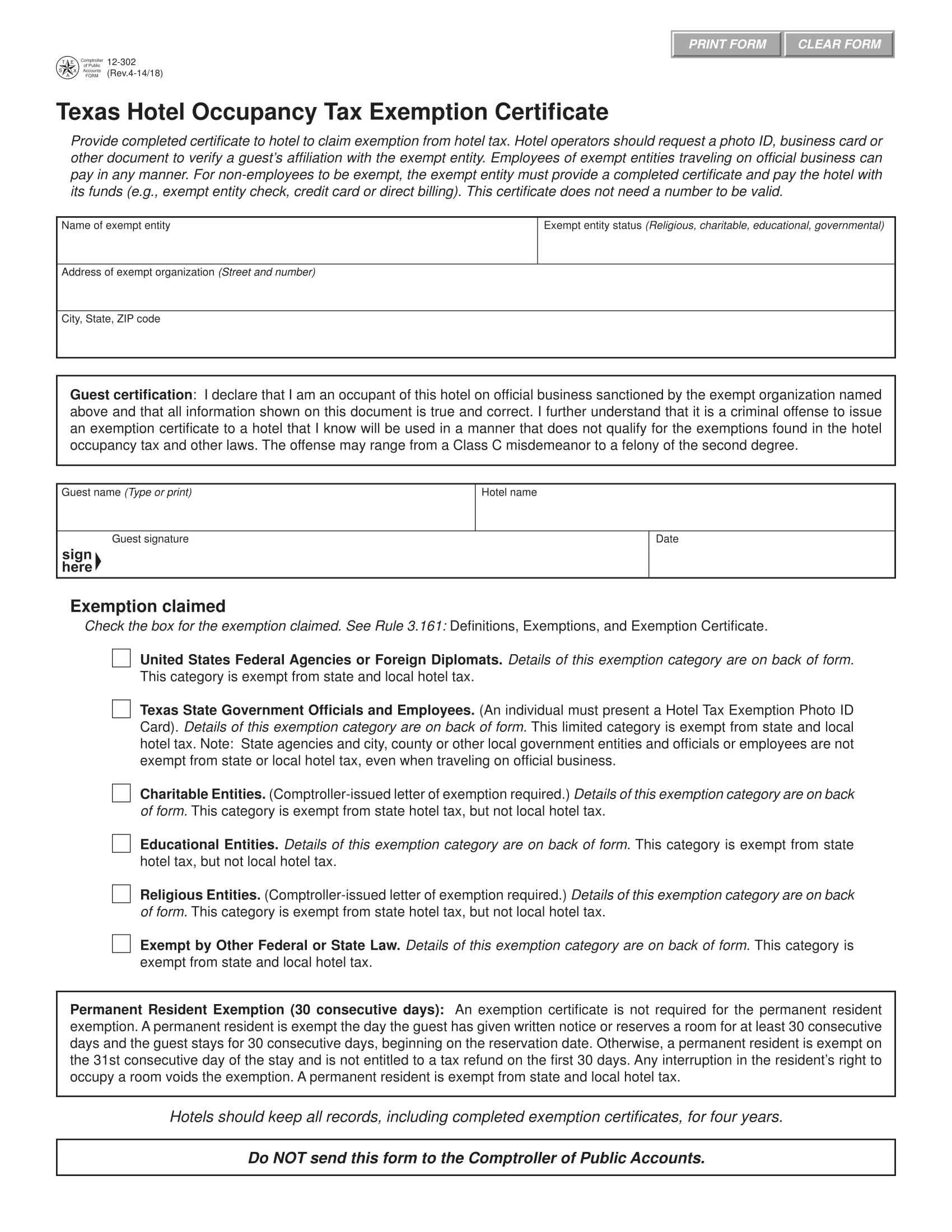

California Hotel Occupancy Tax Exemption Certificate, Regardless of the method, taxpayers must file until october 15, 2025, with payments still due by june 17, 2025. Blank forms can be accessed here or at our public counters.

Filing Exempt On Taxes For 6 Months How To Do This, The business tax renewal form is broken into seven sections:. What is the deadline for filing california state taxes in 2025?

A resale certificate indicates the item was in good faith that the purchaser would resell the item and report tax on the final sale.